In the financial services sector, managing large portfolios and reconciling transactions are complex and time-consuming tasks. Asset managers, private equity firms, and corporate finance teams face challenges in data analysis and management, risking inefficiencies and high costs. To address these challenges, an innovative financial platform was developed to automate critical processes, improving accuracy and reducing operational costs.

Financial sector companies often struggle with:

• Slow and error-prone manual processes for transaction reconciliation.

• Complex portfolio analysis requiring advanced and customizable tools.

• Difficulty adapting to market changes due to inflexible systems.

A solution was needed to optimize these processes, ensuring greater efficiency and service quality.

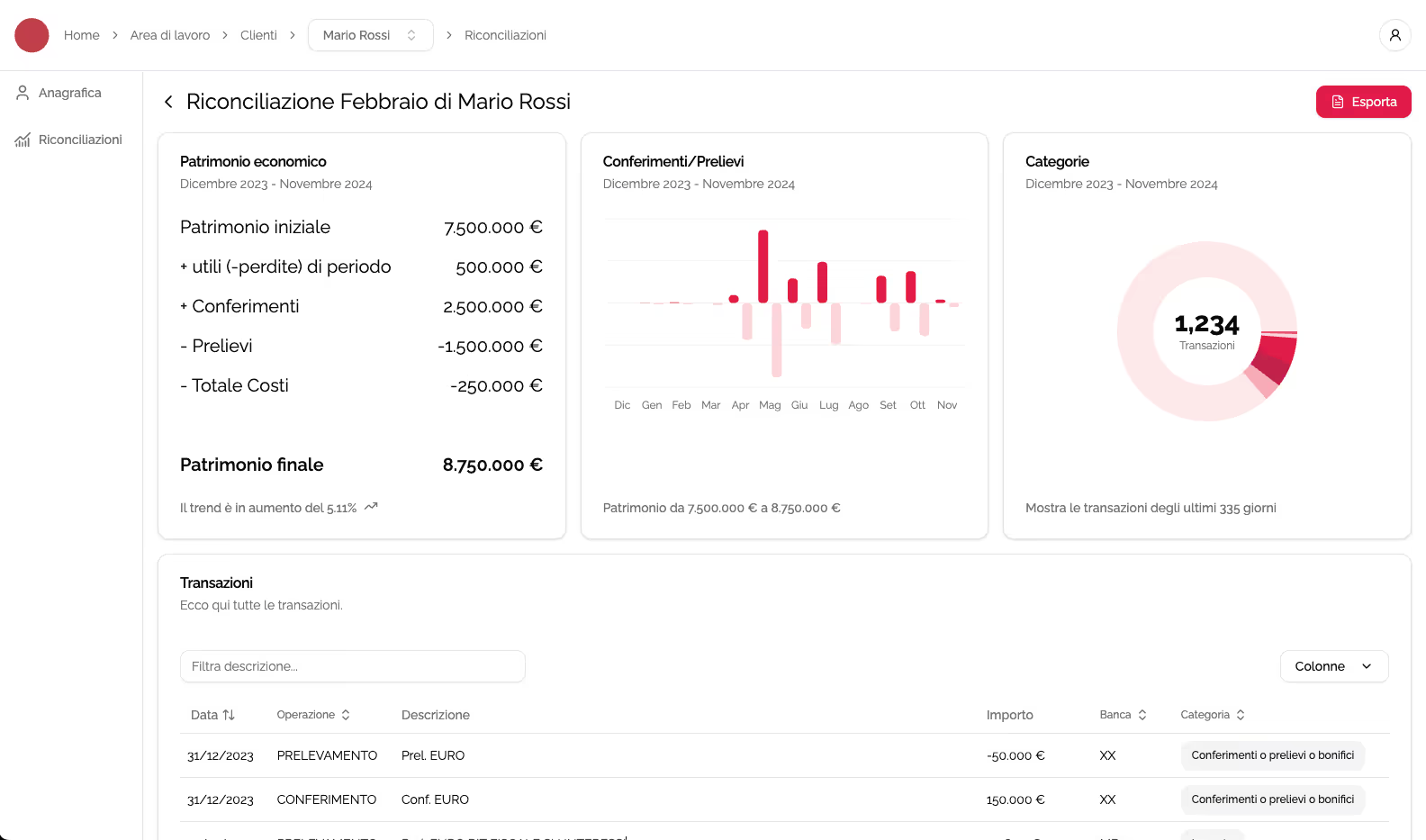

Our platform introduced an automated system for financial operations management:

• Operational Efficiency: Significantly reduces manual workload by automating reconciliation.

• Service Quality: Provides advanced analysis and visualization tools to enhance user experience.

• Improved Competitiveness: More efficient processes and accurate data provide a strategic market advantage.

• Flexibility and Scalability: The platform adapts to evolving business needs, ensuring continuity and innovation.

The platform implementation has led to tangible improvements:

• 50% reduction in time spent on financial reconciliation, increasing team productivity.

• Increased data accuracy, reducing errors in financial analysis and improving reporting quality.

• Optimized operational costs by reducing manual activities.

• Greater market competitiveness with more efficient processes and an improved customer experience.